31+ does mortgage pay property tax

Web Your mortgage company should have mailed you a statement Form 1098 that outlines how much you paid in principal and interest. Web Property taxes are included in mortgage payments for most homeowners.

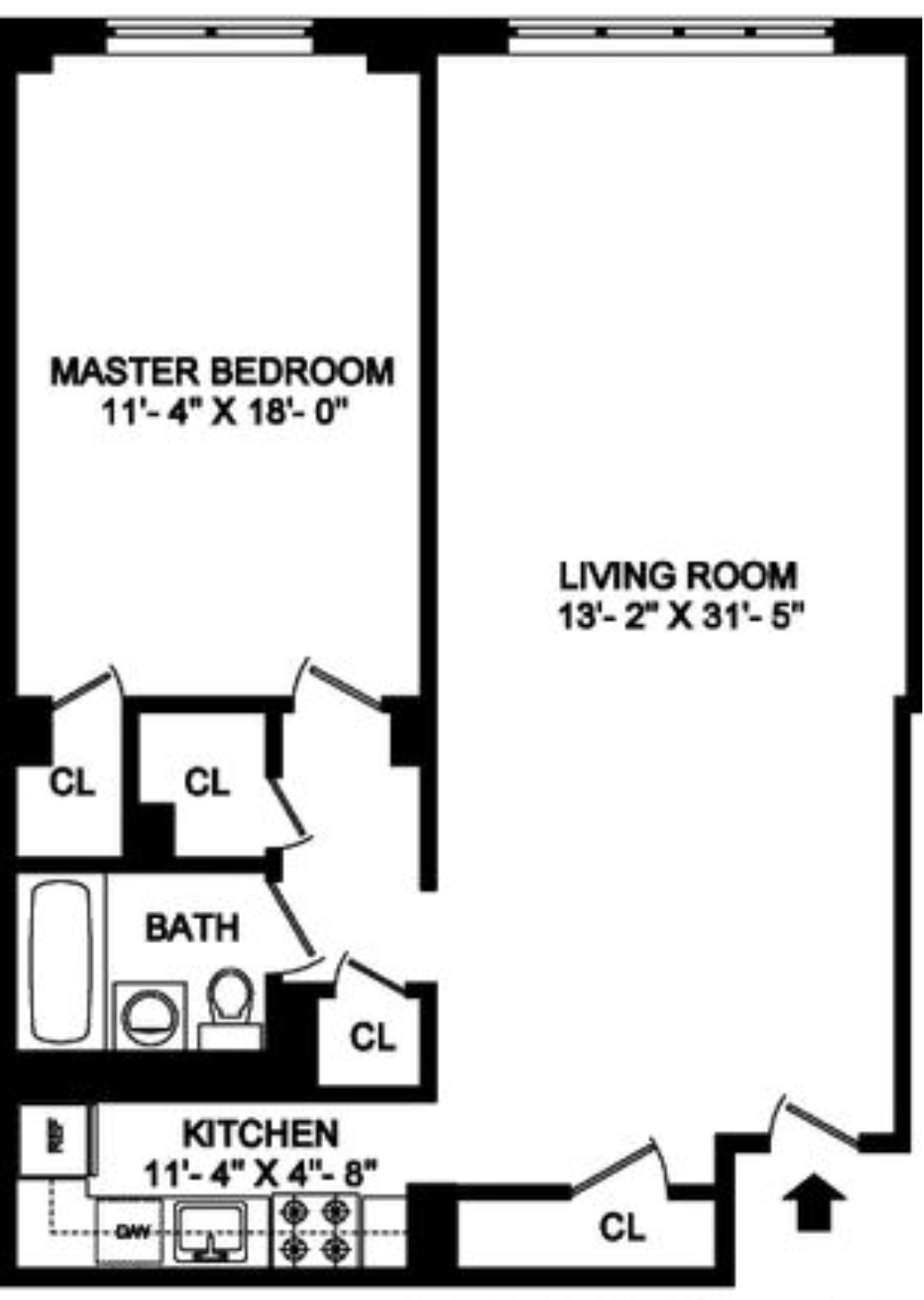

139 East 33rd Street Unit 14b Manhattan Ny 10016 Compass

Call our automated phone system at 1-877.

. Web If the amount you realize which generally includes any cash or other property you receive plus any of your indebtedness the buyer assumes or is otherwise paid off as. Web Property taxes like income taxes are nonnegotiable meaning you have to pay them. For tax years before 2018 the interest paid on up to 1 million of acquisition.

If your homeowners insurance. Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today. Veterans Use This Powerful VA Loan Benefit For Your Next Home.

Web If youre behind on your mortgage payments by more than 30 days the lender isnt required to pay your property taxes. Web The property tax rate that you pay at the local county and state level is often referred to as the millage rate or mill rate. Web The Biden administrations plan to cancel up to 20000 in student debt for tens of millions of Americans is on hold until the Supreme Court decides if the relief policy is.

These rates are usually based on how much. One mill equals one one-thousandth of a dollar or 1. If you qualify for a.

Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns. Ad Finance raw land with fixed or variable rates flexible payments and no max loan amount. Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today.

Get an idea of your estimated payments or loan possibilities. Ad Calculate Your Payment with 0 Down. Web The IRS places several limits on the amount of interest that you can deduct each year.

Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. Homeowners who bought houses before. Discover Helpful Information And Resources On Taxes From AARP.

Try our mortgage calculator. Web Your monthly payment includes your mortgage payment consisting of principal and interest as well as property taxes and homeowners insurance. Web If your home was assessed at 400000 and the property tax rate is 062 you would pay 2480 in property taxes 400000 x 00062 2480.

If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. The tax rate can also be expressed as the millage rate. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. However if theres still money in your escrow. You should report that information on your tax.

If you dont you put yourself at risk of mortgage liens or foreclosure. Web Assessed home value x tax rate property tax. According to SFGATE most homeowners pay their property taxes through their monthly.

Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. Web If your real estate property tax bill is 3000 per year the lender will set the monthly amount you pay into the escrow account at 250.

Better Homes And Gardens Real Estate Metro Brokers

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

Help My Mortgage Company Paid My Past Due Property Taxes

2000 Highway 68 Niota Tn 37826 Compass

Hecht Group Do You Pay Property Taxes And Pmi

Mortgage 101 What S In Your Mortgage Payment

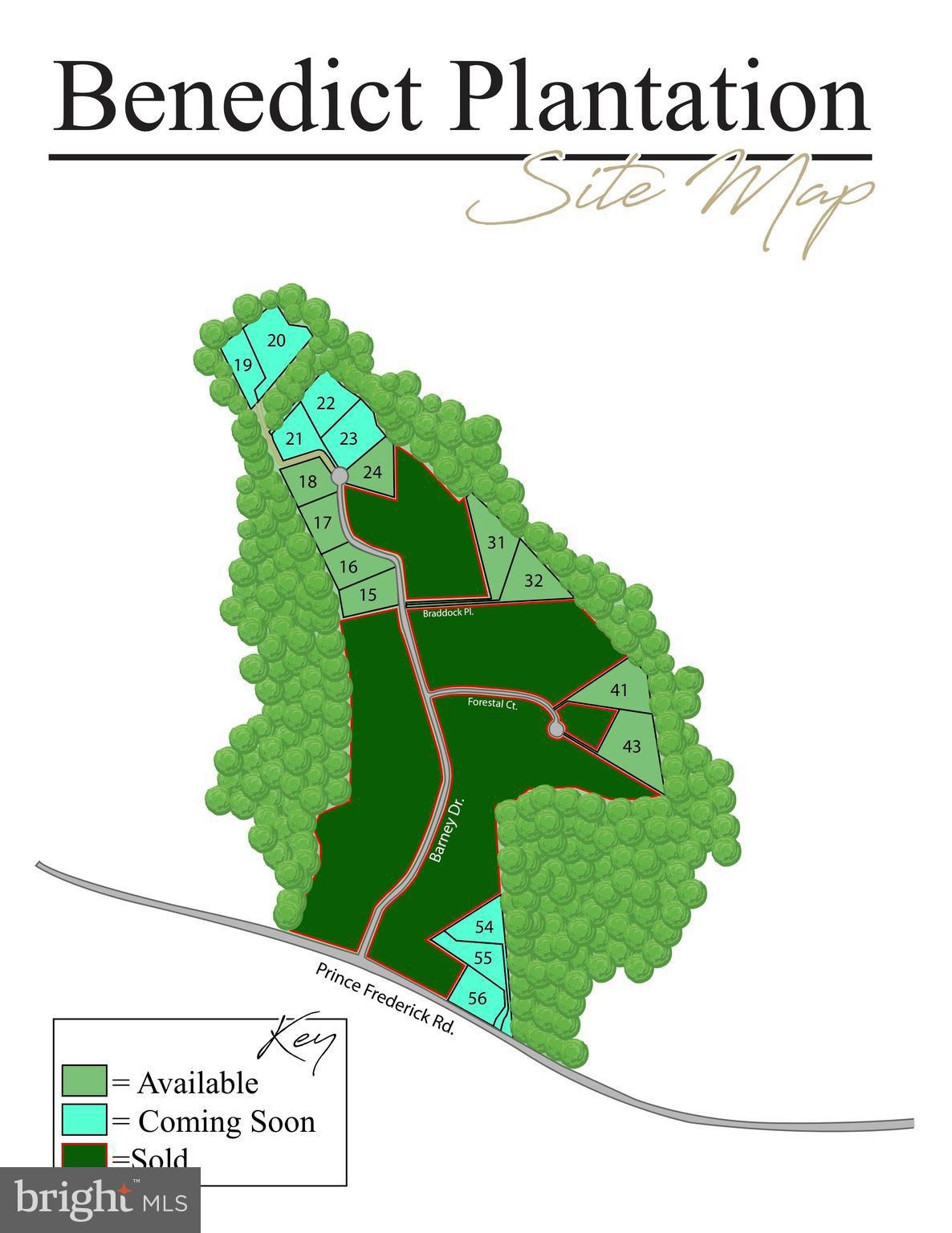

Charles County Md Land Lots For Sale Pg 8 Homes Com

What Am I Paying For With My Monthly Mortgage Payment

Village Post August 2022 By Post City Magazines Issuu

.JPG)

Help To Buy Scheme Estate Agents Sandersons

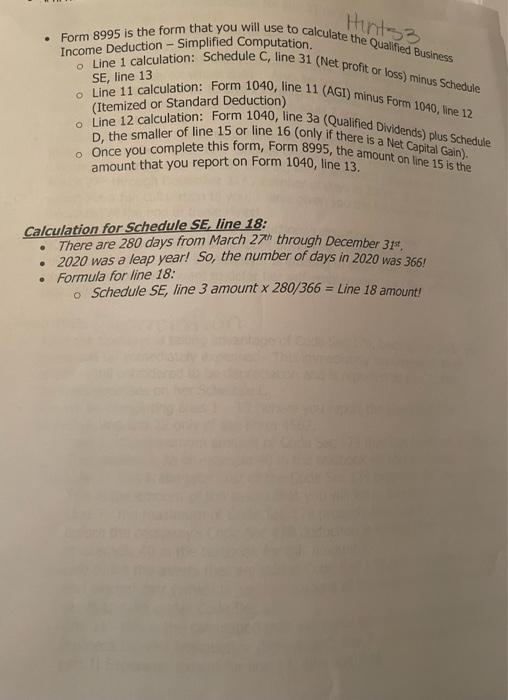

Solved All Listed Forms Will Be Used With An Agi Check Chegg Com

What Tax Breaks Do Homeowners Get In New York

Are Property Taxes Included In Mortgage Payments Smartasset

Mncid6kvedcqvm

Hecht Group Do You Pay Property Taxes And Pmi

The Financial Budget Manual By Aginfo Issuu

How Much Does It Cost To Buy A House Full Breakdown Before You Jump In In 2023